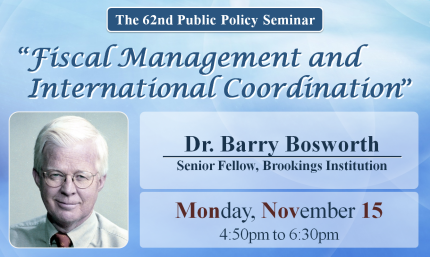

第62回公共政策セミナー

「財政運営と国際協調」

“Fiscal Management and International Coordination”

バリー・ボズワース氏(ブルッキングス研究所上級研究員)

| 日 時 : | 2011年11月15日(月) 16:50~18:30 |

|---|---|

| 会 場 : | 東京大学本郷キャンパス 赤門総合研究棟地下1階第8教室 |

| 司 会 : | 井堀 利宏(東京大学大学院経済学研究科教授) |

| 言 語 : | 英語 |

| 共 催 : | 公益財団法人 野村財団 |

バリー・ボズワース氏(ブルッキングス研究所上級研究員)

11月15日(月)赤門総合研究棟地下1階第8教室において、バリー・ボズワース氏(ブルッキングス研究所上級研究員)による第62回公共政策セミナーが開催されました。

“Fiscal Policy in a Rebalancing World”というテーマについて、活発な議論がなされました。

Summary

On November 15th, Dr. Barry Bosworth, Senior Fellow at the Brookings Institution, delivered the keynote speech at the 62nd Public Policy Seminar—“Fiscal Policy In A Rebalancing World.” Professor Toshihiro Ihori moderated the lecture, and the Nomura Foundation co-hosted the event.

Dr. Bosworth began the seminar by noting that what many refer to as the global financial crisis was, in fact, not global, but rather a condition that plagued primarily the developed countries of the world. Many of the emerging economies, he continued, did not experience a financial crisis at all. An economic downturn, yes, but this was a byproduct of the collapse of global trade itself, which was induced by restricting financial markets in the US and Europe.

Noting the strength and resilience of emerging market economies post-crisis, Dr. Bosworth said that the US is and will continue to restructure its economy, which in turn means a restructuring of the global economy. America will need to move away from its two-decade consumption binge and work towards a more balanced trade portfolio. Complicating this process is the fact that the two traditional tools that the US would seek to use —monetary and fiscal policy— are largely exhausted and severely handicapped, with interest rates having reached zero and further stimulus measures lacking the political capital necessary to make them a reality.

Dr. Bosworth also commented on the current US plan of quantitative easing, noting similarities with Japan's failed attempt during its “lost decade.” He remains unconvinced that this is the appropriate policy initiative, and skeptical of the assumption that “we can do it better” (than Japan did).

He continued by drawing further similarities between the US and Japan, noting that the fear in America is that it will mimic Japan's prolonged stagnated economy. Indeed, it is already showing signs of doing so: the threat of high unemployment and limited macroeconomic policy options plague(d) both countries. Posing an additional obstacle to US recovery is the fact that while Japan was a large creditor country throughout its economic downturn in the 1990's and continues to poses a large current account surplus, the US is the world's largest gross debtor nation with chronic trade imbalances. Dr. Bosworth believes the US will undergo a prolonged economic stagnation, similar to, or perhaps more severe than, what Japan has experienced.

Speaking on saving and investment trends, Dr. Bosworth noted how Japan's household saving rates have declined in recent years and now, as a percent of net income, Japanese households actually save less than US households. In contrast, corporations have been increasing their savings, averaging about 8% between 2000 and 2008. In contrast, US corporations are leaner, with corporate savings currently at around 3% of net income. Lean, in a stagnated economy undergoing fundamental change, may bode poorly for these US companies moving forward, especially considering that corporate investment is hovering around zero percent.

In some respects, Dr. Bosworth said, the crisis actually helped the US in that net exports rose and consumption fell, helping to partially rectify its troubling current account deficit. Moving forward, the US would like to continue on this path, but as can be seen in the recent G20 meeting, he said, “the international community does not want to play ball.” Foreign countries have become accustomed to US mass consumption. Restructuring the global economy will be politically very difficult.

Commenting on the US financial bailout, Dr. Bosworth believes the $700 billion asset purchase initiative (TARP) was a resounding success and has recouped almost all of its outlays. The public, however, does not see it this way, which removes any similarly designed program as a future policy option. Public opinion will not tolerate another Wall Street bailout.

Regarding short-run challenges facing the US, Dr. Bosworth commented on the recent hot topic policy that the Obama administration has decided to move forward with: extend, in principle, the Bush tax cuts. Although Dr. Bosworth believes these cuts may be become “permanent,” he recommends that they be designed with a degree of flexibility, so that if economic recovery becomes a reality they may be reintroduced in order to reinvigorate federal revenue. If these cuts do now expire, the US faces not simply a historically low revenue share (16% of GDP) but also a doubling of the deficit by 2015.

Continuing with federal revenue in mind, Dr. Bosworth spoke on the US long-term budget outlook. Less than 40% of the federal outlay is subject to annual appropriations, and this is projected to fall to 30% by 2020. Working within this restricted budget, Dr. Bosworth believes heath care costs and Social Security will dominate long-run budget issues. Specifically, almost all increases in outlays will be accounted for by a rise in medical care spending, namely in the form of Medicare and Medicaid.

While there are no easy answers to the health care financing problem, Dr. Bosworth suggested adopting a value added tax (VAT), pointing out that the US is the only remaining OECD country without such a tax system. Although this would take approximately two to three years to implement, it would help address both medium and long-term budget shortfalls. Another option for increasing federal revenue, said Dr. Bosworth, is the introduction of an environmental tax. Cap-and-trade is not ideal, he said, as it's too complicated and rife with loopholes. He prefers simply taxing pollution, which will raise revenue and address important environmental externalities.

In conclusion, Dr. Bosworth said that we should not expect the US economy to perform well in the next decade. The obstacles remain too great, and political infighting will further prohibit policy action needed to address measures related to restructuring the economy. The US economy “is likely to stay weak for years to come,” said Dr. Bosworth, “I do not see this as a passing problem.”