Use of social media

On average, people spend 2 hours and 27 minutes on social media every day. One of the first popular messenger applications, Yahoo, was introduced 23 years ago in 1999. People in their 20s were born during the rise of social media. The younger generations, influenced by the evolution of digitalization, receive information and express their opinion through social media. Smartphones also had a significant impact on the spread of social media.

Before using social media, people were silent and passive because the opportunity to express their opinions and voices was limited. Government and policymakers announced their decisions through diverse types of media. There was only one-way communication with the audience. The general public was not invited to the “dinner party” but only waited outside to hear about the party from someone willing to stand on the “soapbox.” The general audience did not have the opportunity to express their opinion.

The advent of social media has put communication in the right way. Now we have two-way communication. Anyone who has internet access can have their voices heard. People do not need a “soapbox” but a single account. Social media also has a significant impact on the communication of policymakers.

What was central bank communication like?

The rise of central bank independence has been a critical catalyst for an increasing role of its communication to maintain financial and price stability. To keep their independence, central banks must be accountable and transparent, which can be possible through effective communication. Moreover, how the central bank influences expectations is a matter of communication.

Until recently, most advanced economies had implemented unconventional monetary policies since their conventional policy tools were limited to the zero-lower-bound rate. European Central Bank (ECB) stated that the unconventional monetary policy measures required more explanation; as a result, it made communication a policy tool in itself.

Moreover, the development of information technology, including social media, has broadened the central bank’s audience, including the less knowledgeable general public. This requires more explanation and effort for effective communication.

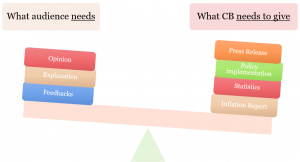

Keeping the balance

When the central bank communicates, there are two important factors to consider. What the audience wants to know and what the central bank needs to communicate. A proper balance between these two factors is essential. When the central bank only gives information on its side, communication might not be effective since the central bank does not consider the needs of its audience. On the other hand, if the central bank focuses greatly on the audience’s needs and opinions, there can be a risk of deviating from financial and price stability, which are the main policy implementation objectives. Public expectations matter for monetary policy formulation and implementation. However, it is also important for the central bank to effectively conduct its policies to achieve its main objectives.

When the central bank communicates, there are two important factors to consider. What the audience wants to know and what the central bank needs to communicate. A proper balance between these two factors is essential. When the central bank only gives information on its side, communication might not be effective since the central bank does not consider the needs of its audience. On the other hand, if the central bank focuses greatly on the audience’s needs and opinions, there can be a risk of deviating from financial and price stability, which are the main policy implementation objectives. Public expectations matter for monetary policy formulation and implementation. However, it is also important for the central bank to effectively conduct its policies to achieve its main objectives.

Building trust online

ECB suggests that when the policy tools are limited, communication can generate expectations. To create positive public expectations, policymakers need specific communication strategies. Social media can build this expectation, in other words, building the “TRUST” online.

Transparent: The word “transparent” means “easy to detect.” Social media can be a transparent window when efficiently used as a communication tool for the central bank. Moreover, there are more than 4.6 billion social media users on the planet. Facebook and YouTube are the most used, with more than 2.2 billion users. As of 2017, 61% of monetary authorities had at least one social media account. The use of social media generates a need for more active communication from the central bank.

Reliable: There is tremendous information flowing daily on social media. Policymakers are under pressure to provide information that may constantly lead to unreliable communication. Therefore, it is vital to be more reliable on the primary mandates rather than trying to react to every social media pressure.

Understandable: Since almost everyone with a smartphone can access social media, the central bank’s audience has greatly broadened. This brought the attention of the unspecialized and less knowledgeable public to the policies of central banks, which require a more careful communication strategy. Clear and straightforward communication is necessary while improving the public’s knowledge about the central bank mandates is also crucial. Short videos, stories, or even simple “understandable” posts can be effective communication tools for social media.

Specific: Public on the social media platform can be more active and influential by clicking the like/unlike button or writing a positive/negative comment on the policy decisions. It can be a “loader” rather than the real voice. The central bank should be very careful in communicating through social media. A single word choice can affect the mass media and their opinions on monetary policy decisions. For instance, during the euro crisis, ECB President Mario Draghi’s phrase “whatever it takes” positively influenced public expectations.

Timely: Social media can be fast and convenient since it is a direct communication tool for the central bank. Moreover, effective communication at the right time can make a tremendous difference in public expectations. Central banks should also not delay providing information about their future policy intentions. In contrast, we also can find out the public intention and opinion in real-time through textual analysis through social media, helping implement its communication.

Central bank communication is not just a way of communication itself, but it has become an essential tool for measuring monetary policy itself. Furthermore, social media has become an excellent catalyst for the effectiveness of central bank communication. With the above strategies, the central bank can gain the public’s TRUST through social media.

This student blog post is deliverables in the context of the International Field Workshop in August 2022 and represents the author’s personal views on the subject. The author was inspired and benefited from a discussion with Mr. Andrew Perrin, Principal Communications Specialist at the Department of Communications of the Asian Development Bank, at a virtual meeting on August 9, 2022. The author sincerely thanks Mr. Andrew Perrin for his time and precious insights.