Despite efforts by governments to promote gender equality in the labour market, the picture at the top of the corporate chain paints a severe forecast. In the U.S., females manage only 21% of firms; in Japan, this figure drops to lower than 14%. Furthermore, female-led firms trail male-led ones in sales, growth, and employee and network size. The paper’s authors investigate an unexplored channel of disadvantages for female CEOs in business operations, particularly how networks are formed. They examine the effect of gender on network opportunities through “homophily,” a preference for relationships to be created based on similar characteristics. The authors hypothesised that gender homophily in transaction networks could reduce the trading opportunities for female CEOs relative to male CEOs, contributing to smaller business networks.

Evidence for CEO gender correlation in firm-to-firm transactions was obtained through annual panel data of roughly 1 million Japanese firms collected by credit reporting company Tokyo Shoko Research. Uniquely, it contained detailed information on supplier-buyer relationships between 2008 to 2020, together with key CEO attributes, allowing the control of potential non-gender homophily variables such as age and education. Inspection of transaction data showed that female CEOs had smaller networks in terms of the number of suppliers and buyers compared to male CEOs. Additionally, a positive relationship was seen between network size and firm performance.

To identify the effects of CEO gender homophily, the authors looked at both supplier and buyer firms for transactions with female CEOs. In an equal market, female-led buyer firms were found to trade more with female-led suppliers than male-led ones. This relative homophily bias was mostly driven by transactions of small and medium-sized enterprises, in which CEOs were more likely to engage in deals directly, supporting the study’s hypothesis.

The effect was confirmed by controlling supplier and buyer fixed effects in a non-linear difference-in-differences approach using network data, as well as other homophily variables. Results showed that CEOs of small-sized firms were 12.6% more likely to trade with a CEO of the same gender than with that of the opposite gender.

To examine the impact of a policy eliminating CEO gender homophily, in which between-gender transactions approached same-gender ones, a counterfactual analysis was conducted. Such a policy was found to increase the overall number of transactions by both female- and male-led firms by 0.45%. Further, it significantly reduced the gender gap by 6.8% due to an increased impact on female-led firms. In other words, it was desirable to pursue a CEO gender policy from the perspectives of both overall efficiency and equity.

Having established evidence for the effect through the firm transaction data, the authors set out to determine what kind of policy would be effective in eliminating CEO gender homophily in the next part of their study. In order to address the underlying mechanisms not observable in the transaction data directly, they conducted a survey of CEOs in collaboration with the Cabinet Office of Japan. In particular, it was crucial to understand whether the low likelihood of between-gender CEO transactions was due to fewer opportunities to meet CEOs of the opposite gender or a preference to avoid them regardless of opportunity. While the former issue could be addressed by proactive government initiatives, the latter would hint at much more complex circumstances behind the imbalance.

Tailoring their survey to distinguish homophily in “meetings” vs “preferences,” 25,000 CEOs from both genders were evenly contacted in February 2023, with 6,437 responses (25.7%). Regarding homophily in “meetings,” it was found that the probability of becoming acquainted with a female CEO was 19.9% for female respondents but only 5.2% for male respondents. These results were skewed significantly from the 14.4% probability that would be expected by random chance.

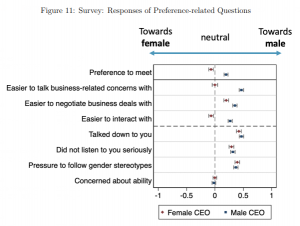

For homophily in “preferences,” male respondents had 46.6% higher expectation for male CEOs to be “easier to talk about business-related concerns” compared to female CEOs, 35.1% higher for “easier to negotiate business deals,” and 26.9% higher for “easier to interact with.”

In contrast, female respondents had closer to a neutral bias, with the exception of 19.8% higher expectations for male CEOs to be “easier to negotiate business deals.” Both genders expressed neutral expectations regarding “task ability.” After controlling for these results on “preferences” and other variables, it was found that they did not account for the limited opportunities for “meetings” with CEOs of the opposite gender.

The authors point to several policy implications from these results. As most CEOs are male, gender bias in firm-to-firm transactions leads to fewer trading opportunities for female CEOs. Government affirmative action to increase the proportion of female CEOs without addressing underlying issues of gender bias would not solve the issues of gated trading opportunities for both genders. The authors hence emphasise that mitigating gender homophily is desired, particularly lowering social barriers to meetings of CEOs between opposite genders, such as through business matching events or online sites, as well as policies to alleviate same-gender preference among male CEOs.

While successfully unmasking some of the issues of gender bias in SME firm-to-firm transactions, the complexities of matching human interactions with business opportunities appear no less confronting after the results. The authors propose that more detailed data on the volume and price of transactions would allow welfare consequences of CEO gender homophily to be assessed more accurately. Furthermore, the question of how transactions among larger firms might be traced to the gender homophily of individuals remains. Hence, the results should issue the first step of many toward understanding the disadvantages that female CEOs face in business operations.

(Edited by Clement Ng)

This research has been conducted under a joint research agreement between the Center for Research and Education in Program Evaluation (CREPE) at the University of Tokyo and Tokyo Shoko Research.

Related page

Discussion paper series | CEO Gender Bias in the Formation of Firm-to-Firm Transactions